Business to Business Rates

Save on B2B Credit Card Processing Fees

0.15% + $0.08 (Card Present)

0.20% + $0.11 (Card Not Present)

above interchange

Keeping Your Costs Low On Card Not Present Transactions

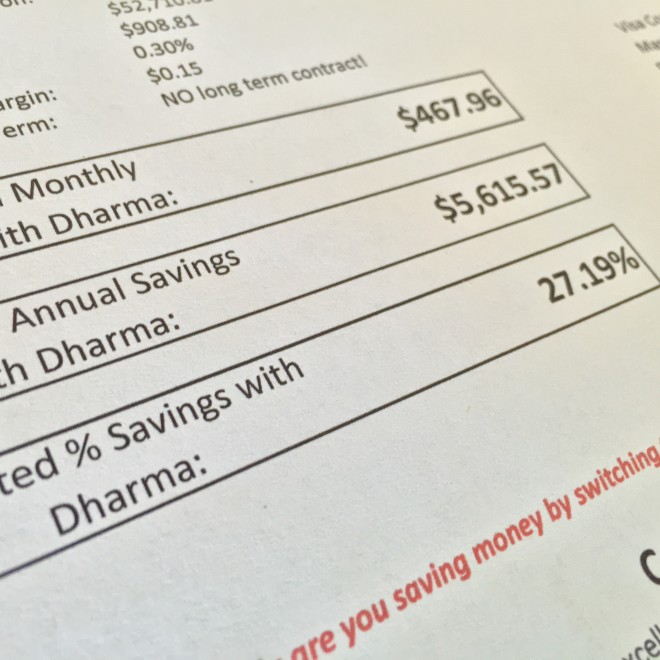

We’ve been at this for a long time, and know about the intricacies of accepting online payments and your card-not-present needs. (Learn about who we work best with, here). Our rates of 0.20% and $0.11 per transaction above Interchange (including AVS!) are some of the lowest out there. Pricing for eCommerce merchant services can be confusing, and that’s why we’ll run a free cost analysis against your current provider to ensure that you’ll get the lowest possible rates with us. Since we only use the Interchange-plus pricing model, we can post our rates proudly knowing that we’re offering fair, consistent pricing..

- All accounts include free access to MX Merchant, including a Virtual Terminal and mobile app

- No early-termination fees or long-term contracts to lock you into our services

- No annual fees, monthly minimums, or hidden fees

- Access to lower B2B interchange rates with the MX B2B App

- Reduced rates for merchants processing over $100k/month

How much will I pay on a $100 sale? See sample rates for popular card types below.

Visa Regulated Debit

| Interchange | 0.05% + $0.22 |

| Assessment Fees | 0.13% + $0.02 |

| Dharma Margins | 0.20% + $0.11 |

| Total Fees (per $100 sale) | $0.73 or 0.73% |

Visa CPS Card Not Present

| Interchange | 1.80% + $0.10 |

| Assessment Fees | 0.14% + $0.02 |

| Dharma Margins | 0.20% + $0.11 |

| Total Fees (per $100 sale) | $2.37 or 2.37% |

Visa CPS Rewards 2

| Interchange | 1.95% + $0.10 |

| Assessment Fees | 0.14% + $0.02 |

| Dharma Margins | 0.20% + $0.11 |

| Total Fees (per $100 sale) | $2.52 or 2.52% |

Mastercard World Merit 1

| Interchange | 2.05% + $0.10 |

| Assessment Fees | 0.12% + $0.02 |

| Dharma Margins | 0.20% + $0.11 |

| Total Fees (per $100 sale) | $2.60 or 2.60% |

Mastercard Corporate Data Rate 1

| Interchange | 2.70% + $0.10 |

| Assessment Fees | 0.12% + $0.02 |

| Dharma Margins | 0.20% + $0.11 |

| Total Fees (per $25 sale) | $3.25 or 3.25% |

American Express Rates

| American Express works differently! | Click here for rates |

We believe in full disclosure here.

| Fee | Dharma’s cost |

| Monthly Fee | $20/month |

| Interchange+ Margins (Visa/MC/Disc) | 0.20% + $0.11/authorization |

| Interchange+ Margins (AMEX) | 0.30% + $0.11/authorization |

| High-Volume (over $100k/mo) Margins | 0.10% + $0.11/authorization |

| Interchange / Card Assessment Fees | Passed-through at cost |

| Closure Fee | $49 |

| AVS Fee | None! |

| Batch Fee | None! |

| PCI Compliance | None! |

| Chargebacks | $25/instance |

| Virtual Terminal | Included for Free |

| Mobile Processing | Included for Free |

| Terminals, and Clover POS | Available |

Interchange-plus pricing.

No surprises, 100% transparency.

This is the fairest pricing model in the industry. Our margins are flat and fixed, so you always get a fair deal. No long-term contracts, no hidden fees.

What’s Included in a new Dharma account?

Dharma provides you both fair terms and the tools you need to accept payments with ease. All accounts come with access to MX Merchant, including:

What does Dharma NOT charge?

There are so few fees that Dharma charges, sometimes it’s easier to list off the things we DON’T charge! Here’s a full list of fees you won’t see at Dharma! No nickel-and-dime games here. We want you to choose us for simplicity, transparency, and low rates.

| Fee | Does Dharma charge it? |

| Annual Fees | No! |

| Monthly Minimum | No! |

| PCI Compliance Fee | No! |

| Early Termination Fee | No! |

| Batch Fee | No! |

| AVS Fee | No! |

| IRS / Regulatory Fee | No! |

| Gross Funding Fee | No! |

| Bank Change Fee | No! |

| Account Update Fee | No! |

| Virtual Terminal Fee | No! |