Read your Welcome Packet

We can’t emphasize this enough. Your Welcome Packet has vital information about your new account. Your Merchant ID, account parameters, and support contact numbers are all listed in your Welcome Packet. Please, read it! Most questions you have will likely be answered there, and there are important tips and guidance about how to best utilize your account. Your Welcome Packet is a great future reference, so please store it somewhere you can readily access later.

Logging in to MX, your Online Portal

Page 6 of your welcome packet

You’ll have easy access to all of your transactions so that you can report on them, see monthly statements, and find out how your customers are paying. Logging into the system is easy, and from the online interface you can download past statements and run other reports. To login, simply:

- Visit https://mxmerchant.com

- Login on the right, entering your new Username (found on page 6 of your welcome packet)

- Enter your temporary password (please change this immediately!)

- Once logged in, Click the User Icon at the top right > edit > Enter new 12-digit alpha- numeric password > Click Save

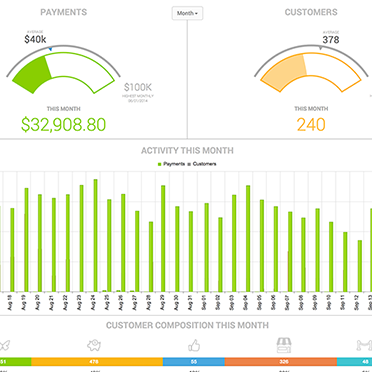

Once you’ve logged into the system, you’ll have detailed reporting capabilities. In addition, this is where you’ll complete your PCI Compliance Self-assessment questionnaire, which you can read about below. For any assistance with the MX system, please reach out to Priority Payments directly, at 800-935-5961.

PCI Compliance

Page 6 of your welcome packet

MX Merchant is where you will sign up for Sysnet / PCI Protection, where PCI compliance is completed. All merchants are required to take this survey annually per Visa/Mastercard regulations. The PCI Compliance Survey will ensure that you are accepting sensitive credit card information in a safe and secure manner. You have 90 days after signing up with Dharma to complete the survey before being assessed a $39.95 PCI noncompliance fee for every month thereafter you are noncompliant. If you process credit cards using an internet connection, you must complete a web-scan. You’ll be informed if this is a requirement after completing your PCI compliance Survey, and will be prompted to complete the web-scan service – this is a hard requirement for all merchants who process over an IP connection, no matter who your processor is. For assistance with your survey please contact Sysnet directly at 888-543-4743, Monday to Friday 8.30am to 8.00pm ET.

To initiate the survey:

- Login to https://mxmerchant.com

- Click “Apps” on the left of the page, then select “Activate” for the Sysnet app.

- Follow the prompts to create a Sysnet / PCI Protection login, and complete your PCI survey.

- Once completed, you will be prompted to enter your name and password to MX Merchant to finalize and submit your survey. Don’t forget to complete the questionnaire every year!

Please contact Priority Payments directly at 800-935-5961 for any assistance with the MX Merchant system or PCI Compliance questions.

We all love the IRS!

We are required by law to confirm with the IRS your Taxpayer Identification Number (TIN). This means that we need to be sure that we have the proper tax information on file. Per US law, if we don’t have the right information on file, we’re required to withhold 28% of your funds! We do NOT want to withhold your funds. Please let us know immediately if the legal information you provided us (listed in your welcome email) does not match page one of your business’ most recent tax return.

It takes up to two weeks for us to confirm your information with the IRS, and we’ll notify you immediately if your account mismatches with the IRS. If you notice that the legal information we have listed in your welcome email doesn’t match your most recent tax return, please let us know immediately at support@dharmams.com.

Next: Who do I call for Support?

Jump to the top of the page

Who do I call for support?

Page 5 of your welcome packet

Priority Payments: Priority is your first resource for any technical support needs! Priority is able to help with terminal malfunctions, batching issues, chargebacks, general billing questions, and any other support issues you have. They have a “four rings or less” guarantee, meaning that you can expect to get a live human being when calling during regular hours of 8am – 8pm. You can call 24 hours a day though, and you’ll be automatically directed to our back-end network (First Data) for after-hours help. You’re always covered!

(800) 935-5961

customersupport@pps.io

Dharma Merchant Services: Here at Dharma, we are available to help you from 8am – 5pm Pacific Standard Time. We are your agent and advocate on your account for non-urgent support needs. Dharma can help you with purchasing new equipment, making updates or changes to your account, or helping with general account questions and billing/funding issues. You can reach us at:

(866) 615-5157

support@dharmams.com

Next: Making Changes to your Account

Jump to the top of the page

Making Changes to your Account

Page 14 of your welcome packet

Often times, you’ll need to make a quick change on your account, and it’s after-hours. That’s OK by us! With MX Merchant, there are many “self-service” updates that can be made without getting a support representative involved. Note – only an “administrator” login can make these changes. Simply login to MX, click “Account” on the left, then select “Merchant Services”. You’ll see an “edit” option for business/owner information, where you can update:

- Owner contact information (address, phone, email)

- Address information (DBA address, phone, email)

- Account name (DBA name only, legal business changes require a signed form)

Upper-level changes will require a signature and approval from the account owner. These will include bank account changes, legal entity updates, or account closures. Just open a support ticket to make updates to your account, any time of day or night. Want to talk to a human? You can do that, too! Just give us a ring during regular business hours (8am – 5pm, PST) at (866) 615-5157 and we’ll make sure the necessary changes get made.

Funding Holds – Where’s my Money?

Page 9 of your welcome packet

A “Funding Hold” is when your transactions process, but the money doesn’t get deposited into your bank account. Most of the time, funds are held because the transaction processed fell outside of your typical processing parameters. Our risk protection team regularly monitors all accounts, and looks for abnormal trends, discrepancies, unusual patterns, and any other indicators of fraud. Fraudsters are unfortunately getting more and more devious, so we’re happy that our fraud protection team is out there watching our accounts, to ensure that your money stays safe! Here are the reasons why funding holds can occur and what you can do to avoid them:

You processed a large transaction, or you’ve processed more volume than normal. Whenever you exceed the settings in your “Fraud Protection Profile” on page 4, this will automatically trigger some “red flags” with the fraud protection team. In order to release the funds, our team will need to review an invoice or receipt to ensure that it wasn’t fraudulent or made in error. You can avoid funding holds by proactively sending a copy of an invoice directly to Priority Payments, informing them the charge is valid. Invoices can be emailed to lossprevention@pps.io and must contain:

- Description of the goods sold or the donation made

- The full cost and terms of the sale

- Customer contact/billing info

- Any associated tracking/shipping information

Your checking account information is out of date or fees are overdue. If you change your checking account or for any reason we can’t withdraw the fees due, this will trigger a funding hold. Please reach out to us at support@dharmams.com or open a support ticket to initiate a checking account update if you need to have your funds deposited to a different account.

We suspect that fraud is actually occurring on your account. If your account security is compromised and fraudulent transactions are suspected (for example hundreds of small transactions running per minute or excessive returns with no matching sales), this will trigger a funding hold so that we can mitigate any potential security and compliance issues. In this case it’s actually a good thing that your funds are held, so the best thing to do is to monitor your merchant account on a regular basis to catch this as soon as possible, then notify us immediately at 866- 615-5157 or support@dharmams.com. If our Fraud Protection Team caught it first and reaches out to you, please respond to them as soon as possible to help stop the fraud from continuing.

Getting the Best Rates

Page 10 of your welcome packet

Whenever possible, swipe/dip the card. Your terminal will automatically gather the information on the magnetic stripe of a swiped credit card, (or the chip in an EMV sale), and use that to check for fraud by comparing that information against the issuing bank’s database. If you skip this step, and instead key in a transaction, you’re not allowing the bank to run this extra security step. Because of this, your rates on keyed transactions will be surcharged. If you’re processing online or with phone-orders, you’ll never get the opportunity to swipe the card – so you can ignore this step.

When keying transactions in, use AVS if possible. When your Terminal or Virtual Terminal prompts you for address information, follow those prompts! By filling this information in, you’re getting the benefit of the Address Verification Service. Bypassing AVS results in the transaction being charged at a higher rate.

Batch out sales on every day you process. If you fail to batch out transactions in a timely manner, you risk allowing those transactions to get downgraded to a high-risk rate category, resulting in higher fees. If you wait too long, the authorizations will expire and you will not be able to settle and be funded for those transactions. We recommend batching out your transactions on every day that you process. If you use Authorize.net, batches will automatically be sent on a daily basis on your behalf, so you have no further action to take.

If you’re processing a refund on the same day as the original transaction, don’t refund the transaction – VOID it. A “void” removes the transaction from the daily batch so it is not sent for settlement. The authorization will remain on your customer’s card but their card will not be charged. Since you should be settling transactions on the same day that you process them, that means that you can only void transactions on the day that the transaction took place. It’s worth your time, though – by voiding a transaction, you only pay for the original authorization, and you avoid paying the % fee charged upon settlement!

Fraud is a Bummer!

Page 12 of your welcome packet

Trust your instincts – fraud resulting in financial loss is YOUR responsibility! Think of accepting credit cards just like cash. With big bills, retailers always check the bill to make sure it’s not counterfeit – because if your business accepts a counterfeit bill, it’s your business who will absorb the loss. The same applies with credit cards! If you take a credit card that is later determined to be fraudulent, your business is responsible for any fees or losses stemming from that fraud. Don’t ever hesitate to ask for more information from your cardholder to verify the sale! If something seems too good to be true, it probably is. Ultimately, you are responsible for the validity of your transactions – so if it doesn’t feel right, just ask yourself one question – “Can I afford to absorb the loss of the goods AND any revenue that is at stake for this sale?” If the answer to that question is “NO!”, we highly recommend turning the sale down, or requesting a different form of payment.

Always capture a receipt. This is your first line of defense in a chargeback. Our processing bank will request a copy of a receipt for any contested transaction, so make sure you keep records of them! You can also compare signatures on the receipt to what’s on the customer’s card as an extra line of defense. If the customer’s credit card has a photo on it, feel free to use it! If the photo doesn’t match the customer, don’t accept the card.

Be on the Lookout for “Card Testing” through your website. Fraudsters can be smart! Sometimes, they’ll purchase a list of phony credit cards, and will attempt to run ALL of their phony cards at once, with the intention of figuring out which ones are valid. When doing so, they’ll typically run hundreds, if not thousands of small-value sales on your website. If you process online, this can result in many unexpected fees as well as chargebacks, which can be quite costly. You can prevent this by setting a “Daily Velocity Filter” on your gateway, to limit the number of sales that automatically process during any time period. Learn more about Authorize.net’s Fraud Protection here.

Only take phone orders from customers you trust. By processing in a card-not-present environment, your risk factors increase greatly. If anything seems “off” or “fishy” when processing phone/internet sales, we recommend requesting a different form of payment, such as wire transfer or check. Here are some common red-flags to look out for:

- First time shoppers

- Rush Shipments

- Larger than usual orders

- Different billing/shipping addresses

- Multiple payment types on single order

- Multiple purchases of the same item

- International orders

- Many “Big-ticket” sales

Reading Your Statements

Page 16 of your welcome packet

You can easily obtain an electronic statement at the beginning of every month, and it will reflect the activity for the month prior. You can download this from the MX console (read how to login to MX above). So, in March, you’ll be able to download a statement for all of February’s transactions and fees. Please reference the sample statement on your welcome packet, or visit this page for a full breakdown of your statement. If you’d like to receive a paper statement in the mail, simply reach out to us at support@dharmams.com so that we can enable that feature.

Stay in Touch!

Page 15 of your welcome packet

Our Newsletter: We share industry updates, fee changes, and important deadlines in our monthly newsletter. Typically, our newsletters will have much more explanation and helpful instruction than what is on your statement messaging. Also, there always seems to be something new to share with our merchants, and we like staying in touch. Plus, we include tips to keep costs down, fraud prevention and protection measures, as well as featured merchants doing inspiring work. Keep your eyes peeled for our monthly messages!

Our Blog: In addition to our monthly newsletter, we have great information on our Dharma Blog. We do our best to share stories from our community, examples of our commitment to commerce with compassion, as well as messaging about the payment processing industry in the context of social responsibility. We look forward to your comments! Check out our blog here.

Twitter: As part of our commitment to the Sacred Commerce practice, we tweet our weekly “clearing question” on the Dharma Twitter Page. View our Twitter feed here.

Facebook: Come check out our Facebook page! We’re connected with some pretty cool companies. Who knows, you just may find another perfect match… check out our FaceBook page here.