Annual 1099 Forms

Posted in Customer Support, Industry News and tagged with 1099, FAQ, support.

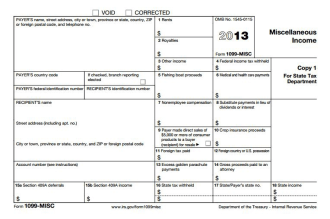

Annual 1099 Forms

There are a couple of important reminders as we head into the new year: the first is that all Dharma MS merchants will be receiving annual 1099 forms via snail mail by January 31, 2016 as per the regulations passed by the IRS (which have been in effect since January 1, 2011). Since Dharma has used various back-end providers over the years, these will be posted by those entities – i.e. Pivotal, Moneris, Priority, etc. This information will include the gross card sales (not net minus the fees) that were processed for the entire year using the Taxpayer Identification Number (TIN) that was given to Dharma as the legal number – like a sole proprietor’s social security number or the Employer Identification Number (EIN) issued by the IRS. Also, for merchants with multiple locations, only one 1099 will be issued as long as all locations share the same TIN.

And here is the second reminder, which is the a biggie: if the TIN given to Dharma on the original merchant application does not match the IRS’s records, your merchant account could be subject to tax withholding of 28% of your card volume! So if there has been a legal change or transfer of business, this must be addressed by year’s end. Please review our FAQ or contact us with any questions or concerns.