How quickly will I receive my funds?

Funding ranges from one to two days, depending on certain factors. Read on to learn about your funding schedule.

What determines funding?

While we can safely predict that all Dharma merchants will have two-day funding, and many will even have one-day funding, there are a few issues that will affect your funding schedule.

Funding depends on how you accept cards, what platform you process on (and if you meet that platform’s batch close time), and in some cases your Merchant Category Code.

Confused yet? Read on…

Know your processing platform

The biggest deciding factor in your funding schedule is to align to the cut-off time for the platform on which you process. Each platform has its own schedule, and if you close your daily batch before the platform closes its day, you will be part of today’s batch. If you close after the platform cut-off time, you become part of tomorrow’s batch.

Dharma has merchants on three platforms. Here they are in order of close time:

- Fiserv / First Data Omaha: This is Dharma’s legacy platform, and although we no longer board new merchants on Omaha, we have many existing merchants on it. If your Merchant ID begins with 5180 or 5544, you are on Omaha. Omaha has the earliest cut-off time of any of the platforms: 7pm Eastern / 4pm Pacific.

- TSYS: We offer TSYS to merchants who need it for their Point of Sale system, or have specific terminal needs. TSYS Merchant IDs begin with 8739. TSYS closes its day at 9pm Eastern / 6pm Pacific.

- Fiserv / First Data North: North is our newest platform, and has the latest closing times. If you are on North, your Merchant ID begins with 8152. North closes its day at 2am Eastern / 11pm Pacific. There is an exception if you are using the MX Merchant Virtual terminal to process: in that case, the closing times are one hour earlier, 1am Eastern / 10pm Pacific. Please note: because of the late close time, the funds may not post to your bank until midday, rather than first thing in the morning.

If you purchase a terminal from Dharma, we always align the terminal batch close time to the platform, unless you tell us otherwise.

If you are using MX Merchant to processes, it is important to know that MX defaults to a 4am batch close time. You can (and should) update your batch close time to better align with the platform. You can learn how to update your MX Merchant batch close time in this MX Merchant FAQ.

If you use the Authorize.net getaway, their system defaults to Eastern time zone, and a Midnight batch close time. You can learn how to change both the time zone and transaction cut-off time in this Authorize.net FAQ.

Method of acceptance matters too

How a card is handled directly affects the riskiness of the transaction, and therefore influences your funding schedule. When it comes to how you accept cards, there are two main categories:

- Card Present Transactions / In-Person : This is almost always next day funding if you meet the platform’s funding schedule.

- Card Not Present Transactions / Mail Order / Telephone Order / Internet: This is usually two-day funding, although in certain circumstances, it can be accelerated to one-day funding.

If you are a retail store or restaurant, where your customer leaves with their purchase, you are considered the least risky of merchant types, and usually qualify for next-day funding (abbreviated to NDF, and also called one-day funding). Merchants who are new to processing, even in a card present environment, may be required to accept two-day funding for a few months. Once this period has passed with no customer disputes, we can request NDF.

Card not present transactions are considered riskier, regardless of whether you key the card (mail order / telephone order) or the customer does so themselves (Internet). In card not present circumstances, an extra day is always added to funding. This allows consumers an extra 24 hours to notice if a transaction they do not recognize appears on their online card statements and to dispute it if necessary. In certain circumstances, for existing card not present merchants with a long history of dispute-free processing, Dharma may be able to work with our sponsor banks to move you to NDF. We can’t promise it will be approved, but we can try.

What does a two-Day funding schedule look like?

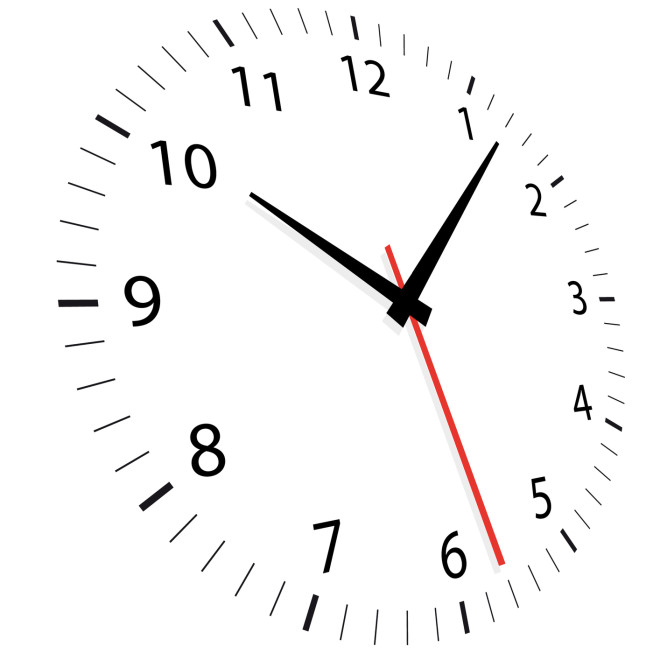

As we mentioned above, all card not present merchants will receive two-day funding. Deposits are not made on weekends or federal holidays. Remember that it’s important to batch out by your platform’s closing time in order to receive the fastest funding.

For this example, we are using the Fiserv / First Data North platform. Adjust your times accordingly for TSYS or Omaha.

| Batch Day/Time (Eastern Time Zone) | Funding Day |

| Thursday (Before 2am Friday morning) | Monday |

| Friday (Any time) | Tuesday |

| Saturday (Any time) | Tuesday |

| Sunday (Before 2am Monday morning) | Tuesday |

| Monday (Before 2am Tuesday morning) | Wednesday |

| Tuesday (Before 2am Wednesday morning) | Thursday |

| Wednesday (Before 2am Thursday morning) | Friday |

Next-day Funding (NDF) Schedule

Next-day funding is usually only granted to card-present merchants, and is dependent on underwriting approval. Deposits are not made on weekends or federal holidays. Remember that it’s important to batch out by your platform’s closing time in order to receive the fastest funding.

For this example, we are using the Fiserv / First Data North platform. Adjust your times accordingly for TSYS or Omaha.

| Batch Day/Time (Eastern Time Zone) | Funding Day |

| Friday (Any time) | Monday |

| Saturday (Any time) | Monday |

| Sunday (Before 2am Monday morning) | Monday |

| Monday (Before 2am Tuesday morning) | Tuesday |

| Tuesday (Before 2am Wednesday morning) | Wednesday |

| Wednesday (Before 2am Thursday morning) | Thursday |

| Thursday (Before 2am Friday morning) | Friday |

What can alter my Funding Schedule?

A few things can change the default funding schedule, or may simply change your deposits in such a way that the funding schedule may not appear obvious.

- Remember, you’re required to submit your transactions to us prior to the platform cutoff time. If you have to batch out after the platform cut-off time, that’s fine. Many businesses prefer to simply delay their funding by a day, and purposely batch-out after the cutoff time, because their business stays open late. This choice is yours.

- Since we usually deposit gross sales amounts into your bank account, we’ll be summing up all the fees owed to Dharma in the background, throughout the month. During the first week of every month, we automatically remove our fees for the previous month’s processing. Fees will usually be taken from the same account into which we deposit your funds. If you are being funded for transactions on the same day we are removing our fees, you’ll see a net deposit for your batch amount, minus the fees you paid. If you had no deposits during the day we remove our fees, you’ll instead see a debit from your account for our full fee amount.

- If you receive a chargeback, these fees will be automatically removed from your next day’s deposits. Chargebacks (or disputes as they are also called) are infrequent, but are very important to keep an eye on. When your customer disputes a transaction and issues a chargeback, per Visa/MC guidelines, the funds are immediately removed from your bank account, until the chargeback is resolved. Should you follow-up and win the chargeback, the fees will be re-deposited into your account. You’ll always receive a chargeback notification in the mail and you’ll also be able to setup text/email notifications in MX Merchant for chargebacks. It’s imperative you follow the instructions closely to properly defend yourself and recoup any lost funds. Failure to respond to a chargeback will result in lost funds, regardless of the actual circumstance of the chargeback.

- Some merchants may be setup with individual deposits. This means that you’ll see a separate deposit to your bank account for each batch you submit. So, if you submit a batch on Friday, then Saturday, then Sunday – you’ll see three separate, individual deposits into your bank account the following Tuesday. If you desire, we can also set an account up with combined deposits, so that instead of three deposits into your account on Tuesday, you’d instead see a combined total as one single deposits. Be sure to discuss funding with your Account Manager if you have any questions.

- Your MCC code may be deemed a high-risk code. For example, high-end jewelry is always more risky than groceries due to the size of the transaction. Even if you are a well established jeweler who’s had a long relationship with Dharma, while your storefront may qualify for next-day funding, online sales are never going to. The chances of something going wrong with that transaction are just too high, and the extra day in the funding cycle gives us a day to stay ahead of fraud or other issues.

In summary

To wrap this all up, assuming you meet other requirements, you are going to see one of the following:

- One-day / next-day funding, if you are an established storefront merchant selling to customers in-person.

- Two-day funding, if you don’t see your merchants and either you or they key the card data in.

Having said that, new storefront merchants who have never accepted cards may not immediately qualify for NDF, and even existing merchants in riskier MCC codes may not get NDF either. And it’s up to you to close your batch to align with the platform close time for your processor.

Any questions about any of this? Feel free to reach out to Dharma Support and they will be happy to answer your questions.