How does Dharma compare costs?

A great question! Comparing costs from different providers can be difficult. We’ll share our methodology and how we approach cost comparisons.

Where to begin?

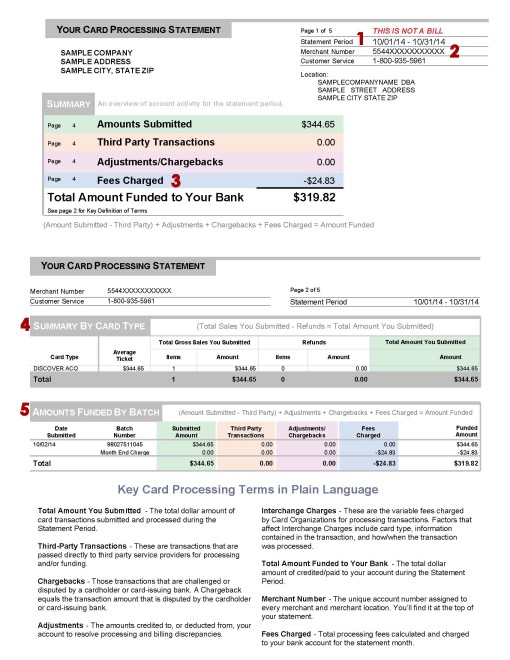

This seems like a basic question, but it’s often the most challenging part. One of the inherent problems when comparing costs in the merchant services industry is that providers use many different pricing models. Often times, it’s tough to compare different pricing models, since certain models intentionally exclude pertinent details. For example, if your organization is currently assessed on a Tiered Pricing model, it’s almost impossible to truly calculate a comparison. That’s because tiered pricing models don’t disclose the underlying costs that make up a credit card sale. Without knowing those underlying costs (known as interchange rates), it’s hard to compare to the transparent pricing model of Interchange-Plus Pricing. So, Dharma is often times required to make a few estimations when running these types of comparisons. Read on to see how we do that.

What assumptions does Dharma make?

So, Dharma has prepared a rate comparison for you. But, we told you “we had to make a few assumptions” – what does that mean? Here’s how we approach assumptions when comparing:

- Tiered pricing models will include “Qualified” and “Non-Qualified” rates. When comparing, we have to determine: what underlying interchange rates would you have accepted based on the rates you received?” Inherently, there is some “best judgment” used when coming to these values, but we always try to be conservative.

- For example – as a Card-Present merchant who is receiving “qualified” rates, we’ll assume that this category represented basic credit cards such as a Visa CPS Retail card, or a Mastercard Merit III card. We also check to see if your current provider is splitting up credit/debit sales, to help us get a better idea of what assumptions to make.

- We look at common trends or history from your current provider. For example – we know that historically, Intuit doesn’t provide a separate rate structure for debit cards – they lump all “qualified” debit and credit sales together. So, when we’re comparing costs against an Intuit statement, we know that we should assume that anytime you were assessed a “qualified” rate, we need to assume that there were both credit and debit cards processed. That’s different than other providers, who provide separate “Debit Qualified” and “Credit Qualified” rates. Essentially – using our trained eyes, we can spot industry trends that a typical merchant may not notice at first glance.

What is Back-Billing, and how does it affect a cost comparison?

Sometimes, we can perform true “Apples – to – Apples” comparisons. This is possible under two circumstances: either your current provider shares the same pricing model as Dharma (interchange-plus), OR they share all of the underlying card types you accepted, so that we can figure out what we would have charged.

Sometimes though, certain providers will perform Back-billing, otherwise known as Bill-back or Enhanced Reduced Recovery. There are many names for this pricing model, but the one big takeaway is that back-billing is NOT transparent, and typically results in much higher fees. What is back-billing, you ask? It’s just what it sounds like – providers will charge a “base” rate, and then they’ll “bill back” additional fees for the same transactions in the following month. So what does this mean?

- Back-billing is inherently convoluted and confusing. It’s fully impossible to determine how much you actually paid as a net rate, due to the fact that the fees for a single transaction will stretch across two month’s worth of billing.

- It’s expensive. MSP’s use this pricing model to “hide” fees, since as the merchant, it’s next to impossible for you to decipher what transaction a fee is associated with.

- It’s inherently challenging to compare pricing models with back-billing. We will always request at least two months’ consecutive statements in order to get as accurate as possible. But fundamentally, we are forced to make general assumptions about your processing when comparing against a provider who uses back-billing.