1099-K Questions

Since 2011, all Merchant Service Providers have been required to provide 1099 forms to merchants.

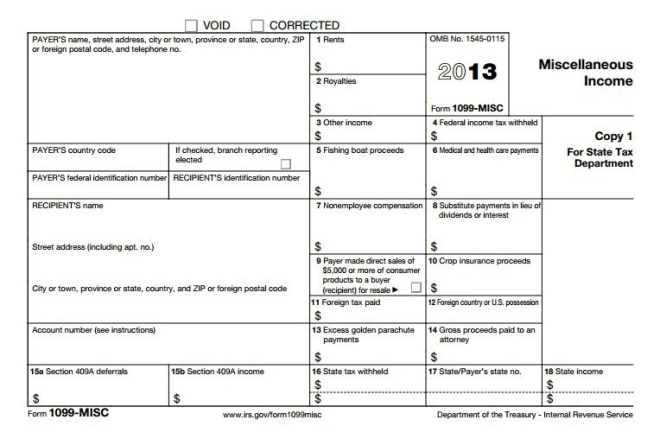

What’s a 1099 Form?

- Starting in 2011, the IRS began mandating that all Merchant Service Providers, like Dharma, report income back to the IRS on an annual basis. Per federal law, we are required to report this information to the IRS.

- 1099-K forms will include the gross processing figures for the previous year, per IRS regulations. It will not include your fees paid or any breakdowns of sales processed.

- As part of the reporting process, you’ll be sent a 1099-K form to comply with IRS regulations, to the address on file with your merchant account.

What other information do I need to know?

- It’s imperative that we have the proper TIN (Taxpayer Identification Number) on file so that we can properly report to the IRS. If we don’t have the proper information on file, your account could be subject to a 28% backup withholding schedule by the IRS! As such – if we or one of our processing partners such as Priority, Moneris, or Pivotal alert you that your TIN is not matching with the IRS, please do respond promptly so that we can quickly rectify the mismatch.

- If you changed merchant service providers in the previous year, you’ll likely receive two different 1099 forms, one from each provider. This is normal and expected.

- If you have multiple business locations all reporting under the same TIN, you’ll only receive one 1099 form. If, however, you have different TINs for each business, you’ll receive a 1099 for each separate entity.